DEXToken Protocol Introduction AMM’s Concept, How To Participate in Staking Reward Rounds

On 20 August 2020 the flow chain foundation had minted 20,000 DEXG tokens on DEXG Ethereum smart contract with the aim of solving the problem of high slippage on decentralized exchanges order matching issues along with liquidity providers order book techniques enhancement.

The DEXG protocol has the aim of introducing a brand new Automated market maker for decentralized exchanges for future trending technological revolution. What their exact plan is to implement in their DEX Token Protocol Exchange and how it could be important for the crypto community involved in DEX(Decentralized Exchange) trading.

Nav Posted Content

Flowchain Foundation

The flowchain foundation had already a native token created on ethereum blockchain on 10 February 2020 with the name of FLC token, total supply was created as 1 Billion tokens. The project is based on the idea of DLT(distributed ledger technology) which has the core features of implementing the internet of things with the functionality of real-time data transactions.

DEX Token Protocol Overview

The DEX Token protocol is come up with the vision of implementing AMM in the decentralized exchanges with their mathematical formula of speculating price from the particular blockchain network different characteristics instead of single party manipulation. In this technique, the automated market maker identifies different parameters of the particular blockchain network and decides the price of that asset which protects the market from sudden whales manipulative behavior or dumping and pumping any asset.

AMM(Automated Market Maker)

The traditional exchanges use order-books, where takers and makers orders get matched and executed successfully. In contrast, decentralized exchanges used market makers for independent trading which made this possible via using the liquidity providers. To regulate this activity, the market makers play an essential role in fair executions of trades and terminate the unusual orders.

DEXToken Protocol Speculative AMM

DEXToken Protocol is trying to implementing its formula-based speculative AMM which is made up of economic rules market regulations and giving a great amount of sustainable breathing room for traders and investors.

On the decentralized exchanges, order volume affects the slippage(the difference between entry price and actual order execution) amount which hurts the traders financially badly. That’s why speculative AMM has an aim to describe the price, not only the asset due to their volatility along with their other characteristics such as transaction requirements and other utilization aspects.

DEXToken Swap Exchange

On the exchange of DEXToken protocol based people can provide liquidity and upon staking the DEXG token and can earn staking rewards on it by getting exchange fees just like Uniswap. The uniqueness of DEXToken protocol is that speculative automated market maker which will play an essential role in controlling trading slippage which affects badly the traders.

The speculative AMM is based on a universal price model which has taken from general economic terms and natural rules which are based on fair principles, resultantly reduce the unfairness and manipulation of market sentiment consequently give a sustainable environment to build a long-term belief in the particular instrument of investors or traders.

DEXG Tokenomics & Staking Reward Events

The theoretical maximum supply of DEXG is 200k in the case of low community support and the price depreciates further below to $30 with the less active addresses which leads to the maximum supply of 200K total tokens minted in the ERC-20 DEXG token after the successful completion of 8 stakings reward rounds.

Although it is possibly not expected even though we can not say surely that the maximum supply of 200K DEXG cannot reach because according to the first round of staking the price of DEXG was above $100 this could be the sign of further price appreciation and more active addresses increments as long as community interest increases.

If the price of DEXG token stay above $60 and steadily grown with the upcoming staking rounds then there will be higher chances of a maximum supply of no more than 70K DEXG token in the market according to the rule of “The more ATH high increase and more active address increases, the fewer supply of DEXG tokens”. After completing the eight rounds of staking all the remaining supply will be burned out and will be usable of remained circulating supply of DEXG tokens which are rewarded during staking rounds, fundamentally causes more price appreciation in DEXG token.

DEXG Token Upcoming Staking Rewards Round Events

As mentioned earlier, the total supply of DEXG tokens will be decided after all rounds of staking rewards completed. The rewards on every round is variable calculated according to the captured data through snapshots of price ATH and active address. In the first round of staking event 6,500 tokens distributed in reward for the IGNITION round run for 7 days between 23rd of September to 30th of September.

In the upcoming events mentioned in the above image the reward amount gradually decreases according to stats as expected possible chances. So the earlier the user comes and buys, stake the more benefit they can avail from it.

23rd October 2020 LUNA DEXG/USDC Staking Reward Round – How to Participate?

Similar to every staking reward round, this round is also unique not just by this name also from these features. During this Reward round you are not just staking the DEXG tokens also you are becoming the liquidity provider of DEXG tokens at Balancer Pool of DEXG/USDC pair market and can earn BAL tokens.

In order to participate in the LUNA rewards round of the expected amount of reward, distribution is 5,250 tokens to the DEXG token stakes at the balancer pool. Every staker’s rewards calculation formula is Your share = Your Looked / Total Locked.

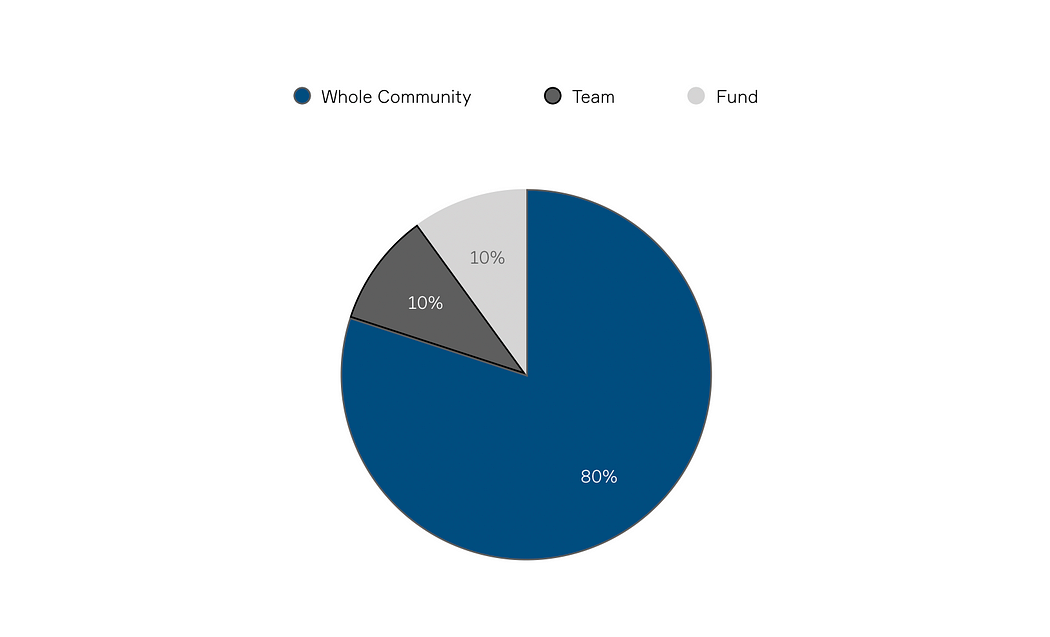

The LUNA round is gonna start on 23rd of October 2020 and for participating in this round you have to go to this balancer official link where you can click on Add liquidity and provide the tokens at the rule of 90% / 10% means that if you provide $10 worth of staking and liquidity on balancer then you can stake or provide liquidity of $9 worth of DEXG and $1 worth of USDC in the pair.

Minimize Transaction Fees While Providing Liquidity

On-time of adding liquidity you can reduce your transaction fees by setting a proxy contract address on the balancer pool which also necessary to complete this and take further steps. Mainly you can buy if you not have already simply USDC to adding liquidity as a single asset and the balancer pool will convert it into DEXG on the appropriate price and stake according to ratio. In this way, you will save ethereum gas fees while providing liquidity on a balancer.

After successfully depositing the liquidity you will receive the BPT tokens which you can see in your wallet by adding the token via contract address of BPT: 0x5b18df96d3c8b9f1d1b9e38752498f92d1e2d490 Now these tokens you need to deposit to stake.dextoken.io for rewards participation for 10 days period.

During this reward period the staker can withdraw their liquidity either end of the round or in between round so they have the liberty of depositing and withdrawing in the LUNA round. Rewards calculation is based on the snapshot of the period you have a stake and the percentage of BPT According to the official announcement.