Aelf Concept Understanding Know-how Explaination

We are going to diving deeper to understand the distributed blockchain-based cloud computing network.

The Problem Solver in the industry of blockchain to meet the sustainable levels to achieve mainstream adoption in the commercial models. Aelf blockchain introduced the well-known blockchain-based cloud computing solution by the concept of a multi-chain parallel computing blockchain framework.

Nav Posted Content

Aelf Blockchain Overview

Aelf has the aim to solve the critical problem in the exciting solutions available in the current market, therefore, the precious technology knows as a distributed block of chains holding back from the business who deserve to adopt and skyrocketed 🚀 their businesses and boost their revenues.

Aelf Vision

The project aelf has mainly focused on scalability through resource segregation and distributed secure independent upgradable consensus models. To achieve the aim, aelf is designed the real-life solution by providing all in one blockchain-based solution in the form of ERC-20 Token ELF token and their blockchain network.

Following Objectives Aelf Intend to utilize to achieve the solution to bring blockchain into real-world actual use cases.

Linux OS

Linux kernel use as a backend solution for different application development and management, therefore, aelf bring it into use and make an OS for blockchain for time saver and for development and execution of smart contracts.

Cross-chain Interaction

Aelf, not just limits to the native blockchain, it also extends the communication with other external blockchain networks like Bitcoin and ethereum for assets sharing and related information.

Solving Debottlenecking

Many blockchain architectures have still yet capacity issues the process transactions that’s why it holds them back from mainstream recognition and real valuation they deserve. Aelf highly focuses on scalability by implementing a multi-chain processing model.

Aelf has provided a solution for smart contract execution with independent native own blockchains from sub-branches of mainchains from Aelf blockchain. Aelf has a tremendous idea of side chains to segregate resources for implementing complex businesses running through the aelf blockchain.

Protocol Model

The blockchain aelf has also the great ability of predefined protocol which can be updatable for further consensus algorithms and the blockchain has always futuristic scope approach.

What is Actually Resources Segregation?

The aelf project has a core objective to scale the business models on the blockchain eco-friendly and they can run smoothly without any scalability problem to fix this aelf taken the decision to build a network without compromising decentralization, security and independence of the blockchain nature give an ecosystem where Different nodes can become part of blockchain with a DPoS (delegated proof of stake) consensus algorithm and can produce blocks by allocating CPU power with the system by dedicated production node role in the network.

Aelf uses resource distribution through a unanimous sense of ecosystem to achieve the desired targets of business models.

Aelf uses the main chain and their sidechains to achieve the scalability fixing issues and achieve the desired objectives. The sidechains are independent and has the ability to create their own smart contracts with native compatible consensus algorithms.

Consensus Algorithm

Aelf uses DPoS delegated proof of stake algorithm this type of consensus is the improvement of the PoS algorithm. Famous cryptocurrency uses DPoS such as EOS, Lisk, Steem, Bitshares, and Others. This type of algorithm is based on the token stake holder’s validation mechanism where the stakeholders can use the voting power for witnesses and delegates to protect the block generation in a consensus manner and earn interest-based of the locking period.

Economics Use In Aelf Blockchain Ecosystem

The main role in the economy of aelf is their tokens. There are 3 types of tokens used in the Aelf ecosystem.

ELF Token, Resources Token, and developer created tokens.

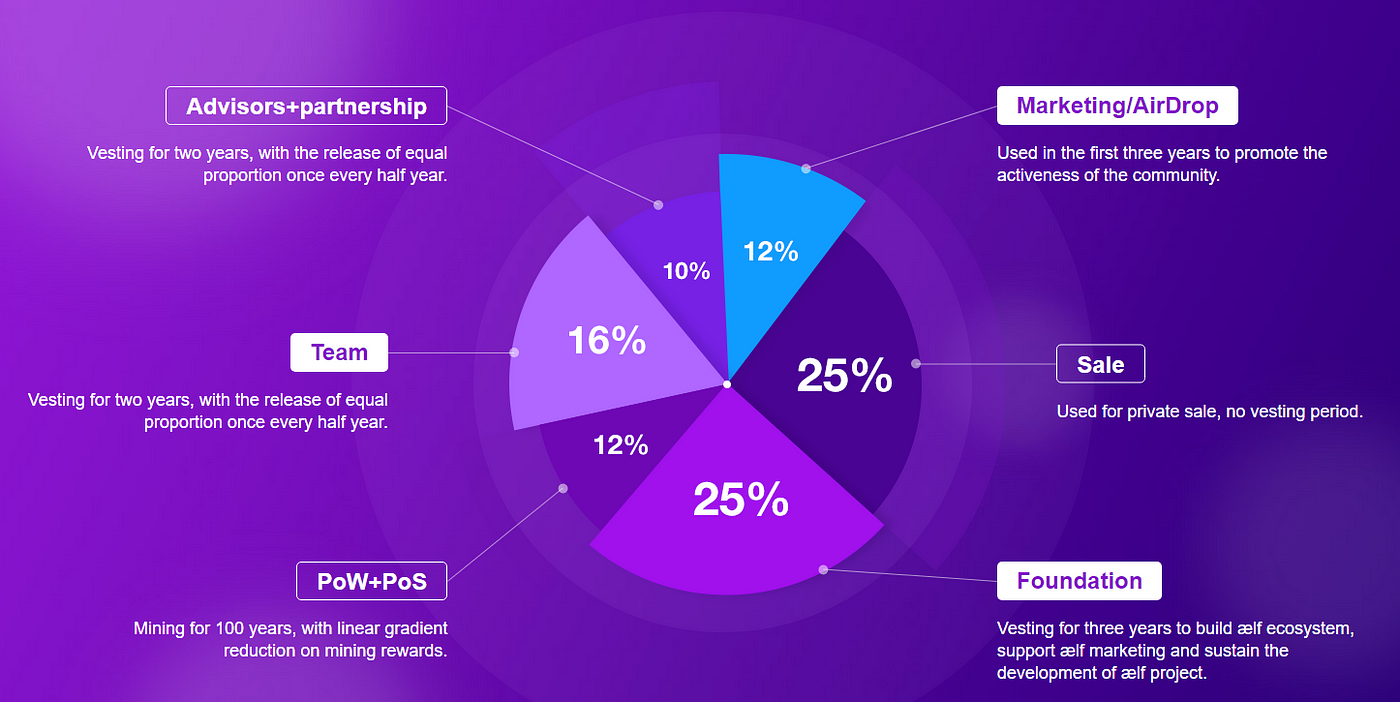

ELF Token Allocation

10% For Advisors and partnership which has some locking period for two years which will release equal proportion once every half year. 12% for marketing/airdrops such as bug bounty and other social media sharing activities to share and get popularity in the industry moreover. The 25% of the allocation will be sale of to private sale which as no locking period they can sell whenever they want and the same amount is for the foundation of the project which has three years of vesting period released gradually with the developments and overall growth of the project so that team will get serious into project actual growth. 12% for Pow+PoS in form of mining for 100 years with the linear gradient reduction on mining rewards with the 4-year halving cycle. again the 16% for a team which has also some two years of vesting period to stay longer serious interest in project growth which will release equal proportion once every half year.

ELF Token Uses

ELF has Core principals of use cases within an aelf network for transaction fees, side-chain indexing fees, production node deposits, voting, and rewards. The token will widely use for transaction fees. Whenever the block production node attaches system they need to deposit less than equals to 100k ELF tokens. The stakeholders use the tokens for proving their voting powers in the network. The production nodes and stakeholders can earn rewards in terms of locking and block rewards.

Resource Tokens

The resource Token will be used as allocating Different Resources for side chains smart contract execution and network computing power consumption Requirements such as CPU, RAM, etc.

DevTokens(Tokens Created By Developers)

The Tokens will be used in the private economic models of the network. These tokens have there own resources allocating mechanism and they can be transferred upon their respective objects.

Aelf Block Rewards Ratio

The reward Block generation in Aelf is initially 0.125 ELF and which will be halved by 50% like Bitcoin blockchain after every 4-year Halving occurs. The maximum supply of ELF and resource token is limited.

ELF = 1 billion, Resource Token = 500 Million.

Burning Mechanism is also included in Aelf Blockchain therefore 10% will be destroyed from the transaction fees and 90% will be entered in the reward pool and the second way destroyed 50% tokens from the resource purchasing.

Earn Rewards By Holding/Locking Tokens.

The stakeholders have a huge opportunity to earn rewards by voting in-network and according to the locking period, you will earn more the longer you lock the higher you earn.

The incentive model for voters is on a daily basis from 3 months locking period to 36 months locking period.

- 1 Year Daily Interest is 0.1%

- 2 Year Daily Interest is 0.15%

- 3 Year Daily Interest is 0.2%

To Know More In-details about Token Economics and Rewards Ratio in Economic Paper of Aelf

Governance in Aelf

The project has ability to found as an independent governance model in a democratic way where the participants of the network can vote for their rights and they can eligible for various services based on their scenarios. In the aelf blockchain, three main groups are responsible for the whole sustainability of an ecosystem and can run the network for their healthy consensus mechanism, where users, candidate nodes, and production nodes are able to govern the network.

Aelf has build four core governance models which are the following.

- Parliament Governance Model

- Association Governance Model

- Referendum Governance Model

- Customized Governance Model

Refer to the WhitePaper for the full understanding and deep learning the whole network eco-system with the technical understanding.

Aelf Partnerships/Investors

The project has big giants lead investors who have solid recognition not just limited to technology also in blockchain-based business models such as Bitmain.com(which is mining farm founder and equipment providers in bitcoin + cryptocurrency mining) Huobi Capital(a big name in crypto trading and has a huge trading volume from Chinese region), HASHED, Blockchain Ventures, and NODE Capital and other good funding providers are linked with project aelf growth which has a major green signal of their long term sustainable growth and development.

Explore Aelf

We can not say this definitely that this is over now to see all aspects of the wonderful solid use case containing a project which has the ability to conquer the masses and serve the community of business and overall growth scenarios. We will explore further this amazing project technology to grab the concepts more closely and understand the opportunities which are linked with this project either they are early or longterm we will analyze on it furthermore in our upcoming postings stay tune for ELF price predictions and technicals to understand and take entry for massive profits growth with the project successes.