Statera (STA) Project Review Concept Behind It & Innovating Behavior About Blockchain

We are going to discovering the newly entered and claimable project called Statera (STA). The ethereum Based ERC-20 token based on Deflationary methodology.

In this article we will see in detail, How-Now and from basic to advance that what are the things and ideas the Statera project brings uniques and which are the chiefly already based concepts which are used by this another claim called a deflationary index fund.

Nav Posted Content

What is Statera?

Statera is the ERC-20 ethereum blockchain-based Token which has dynamic supply created on 03-June-2020 with the initial maximum supply of 100 million, I mean recently but our analysis says that the idea was come into existence in around June 2019 because they have joined twitter on June 2019.

The Statera STA called itself an index fund based token which will be used as a balancer concept to minimize the portfolio volatility risks. The holders who hold cryptocurrency in the pool of Statera, have the advantage of earning returns as well as volatility and panic free holdings in crypto space.

Deflationary Methodology

Yes, the core understanding of this newly created type self-destructing currency to decrease their supply and increase in terms of market value, simpler type of concept already implemented by BOMB Token(Hits it’s all the high of $13 with the initial maximum supply of 1 Million tokens which was just created for the sake of social experiment). Now the Statera is using the simpler concept of 1% of the STA token transaction will be burned and destroyed to ultimately decrease the supply of a particular token called Statera (STA).

Statera Balancer

The Statera Balancer is nothing but an index fund that holds the top tradable cryptos and used as an objective to minimize the portfolio volatility to maintain the prices. When the price of particular WBTC, WETH, LINK, and SNX goes up the smart contract of Pool will sell those cryptos to buy Delta Token in which contain STA and ETH Vice Versa With Selling Point. When the Delta Token price appreciated automatically sell it and rebalance the portfolio index fund to maintain the value of assets.

Index Fund

Phoenix Fund

The second and most important aspect of Statera is the Balancer pool as well as a liquidity provider initially in the portfolios. On Phoenix Fund created initially by them to hold the most volume holding cryptocurrencies. You can provide liquidity and earn returns on it by minimizing the volatility of the holding portfolio fund. This pool is created on the native balancer. exchange with the 40% of Delta token, (allocation of 50% ethereum and 50% Statera STA Token), 30% Wrapped ethereum, 10% Wrapped Bitcoin, 10% Chain Link and 10% Synthetix SNX.

Delta Pool

It is the pool token combo of two assets called ethereum and Statera STA. You can provide liquidity in the pool and hold your fund to get returns on your holdings. This pool is created on the Uniswap dex to provide liquidity within the swap eco-system.

Statera (STA) Token Price Appreciation Expectations

The STA token is based on a deflationary mechanism that means the prices hikes in this token matrix are very much expected either in short-term rallies or long term price spikes hit’s all-time highs is very important to this currency. So in an investor perspective, you should consider this in the area of your internet but make sure you know the drawbacks and risks attach with cryptocurrency investments and you need to clarify with your self that solely aware of a thing is that you are the only responsible for doing crypto purchase in terms of investment or any means because you are only affordable for your losses or profits.

Statera is based on a deflationary smart contract-based index fund token to make a longer-term price appreciatable asset that could use as a day to day transactions or having a store of value for a secure asset holding in a decentralized manner. Whenever the transaction occurs on the ethereum blockchain-based STA token 1% of the transaction burned that means over the course of time it uses more and more token burning event occurs eventually the little supply will be available and if the eco-system needs this token they have to increase its prices which will happen ultimately naturally and which means in the near future if the STA token use cases increase positively then we will possibly deal in decimal points(STA token Has 18 Decimal points) just like bitcoin and eventually price of STA increase very shockingly due to the burning mechanism.

Events Lead Statera To Growth in Price

Main and Important core event in transaction 1% burning on each and every transaction this leads to low supply which in result appreciates at price. So why the people like to transact Statera (STA) token even it gets more expensive and also having more transactional cost?

Yes, we can acknowledge that people have other better options to transact or exchange values with other cryptos as well but still, there are innovative blockchain-based use causes created by the team behind Statera.

Balancer Pool Firstly is that the Statera is the Defi based project and it is still new in the blockchain space takes time make space for it and get more comfortable to understand scopes. Statera aims to protect the portfolios from sudden or inorganic price spikes or declines that mean the large investors can be used very expectedly due to its trustless community-based ethereum smart contract decentralize deflationary mechanism.

Within the pool whenever the rebalancing events occur token burn happen and if the swap or trading arbitrage opportunities available participant get interested to grab profitable opportunities that mean the partially Statera will use as a liquidity provider in the index funds while increase it’s value in- terms of other currencies like popularly use inflationary fiat currencies. The reason is that Statera is the highest deflationary ratio in terms of other contrary commodities like GOLD, Silver which leads to a more valuable asset which still hypothetical but can be possible according to theoretical expectations.

Earning 38%-500% Annual Percentage Yield As Index Fund Holder

STA is still new in the market we can’t say with surety but looking at the already grabbed stats given by their whitepaper that they have gained STA team on Balancer around earned 18% on token drop and 16% fees in returns compound calculative statistics shows 100% APY which is surely hypothetical still as theoretical. How to Provider Liquidity and Earn APY? You can become their liquidity providing by joining one of the Index Pool funds to get part of swaps and earn fees over the period of time the APY depends upon the volume and the interest of STA in the market grabbed by people.

How to Buy Statera Easily, Securely, and Relatively Cheaper?

To buying any kind of crypto easying is not much possible but yes understanding some technical points will be very much plus point proven for you and get an advantage in terms of buying smartly and relatively cheaper by finding and analyzing the resources. The main and current straight forward resources are Dexs liquidity providers as usual like Uniswap and others get listed in future you follow their Statera twitter account to get updates about it.

How to Buy Statera Using MetaMask On Uniswap?

Why There are High Transaction Fees on Ethereum Network nowadays While Purchasing Statera?

Mainly it is due to the high volume of transactions causing the reason of creating different Dapps such as Defi projects like Statera and Other MLM plans like the smart contracts to attract newcomers. The well-known illegal Ponzi scheme on top of all the dApps called Forsage occupying a large number of transactions and cause network congestion on ethereum blockchain and higher transactional cost. Nowadays the ethereum developers working to resolve it but it takes time ethereum 2.0 to come into existence.

Finding a cheaper way to buy Statera is currently a little difficult due to the early stages of exchanges recognition to this new Defi project but still, you can keep an eye on the CMC provided news and Listed exchanges price data, use as favor difference and take decisions accordingly.

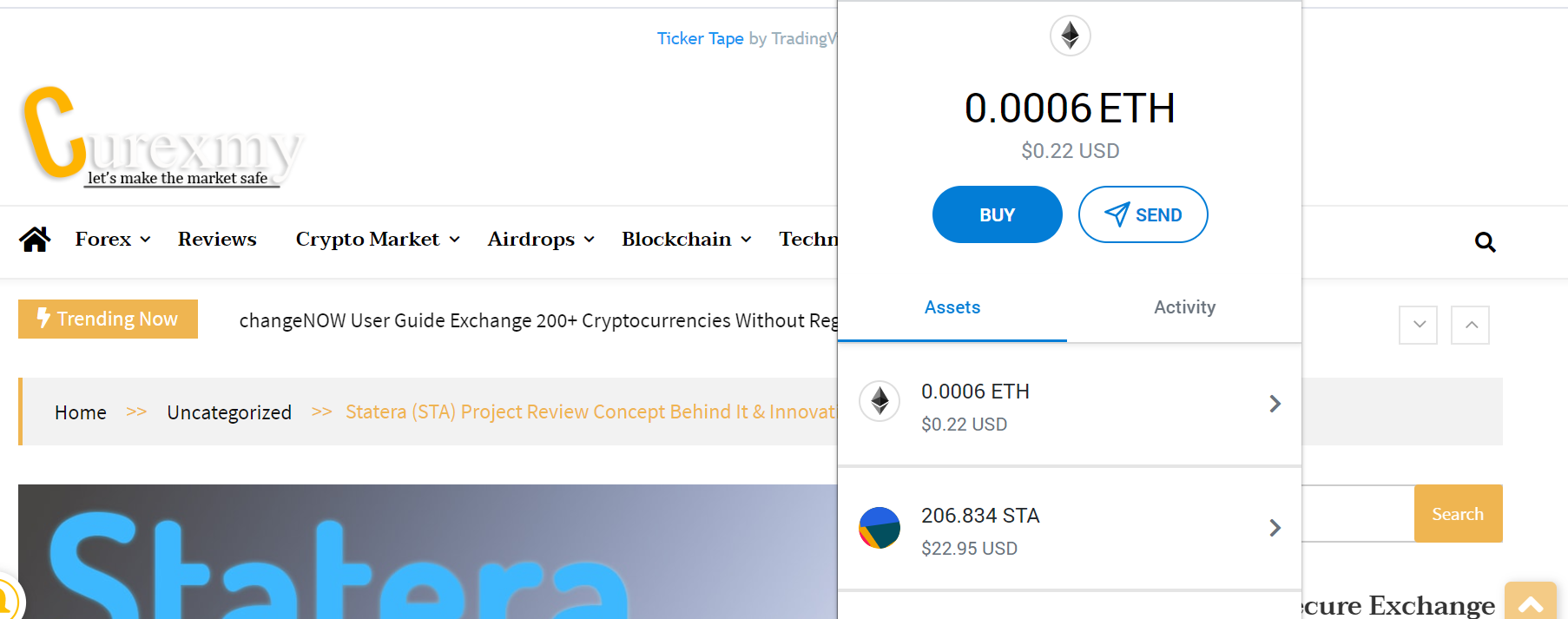

Yup, finally I bought 206 STA Converted on Uniswap From Ethereum it was little early when the AMA starts on Publish0x I was curious to take early entry to see some exploring room and now it gets more expensive still wanted to buy more and of course, the ETH network cause hurdle to purchasing, what’s your opinions about Statera or having a question about this project comments below and let’s discuss. anything interpreted or miss understood or if found confusion kindly let us know to clarify.